Your T4 Statement: What It Is & How To Get It

What is a T4?

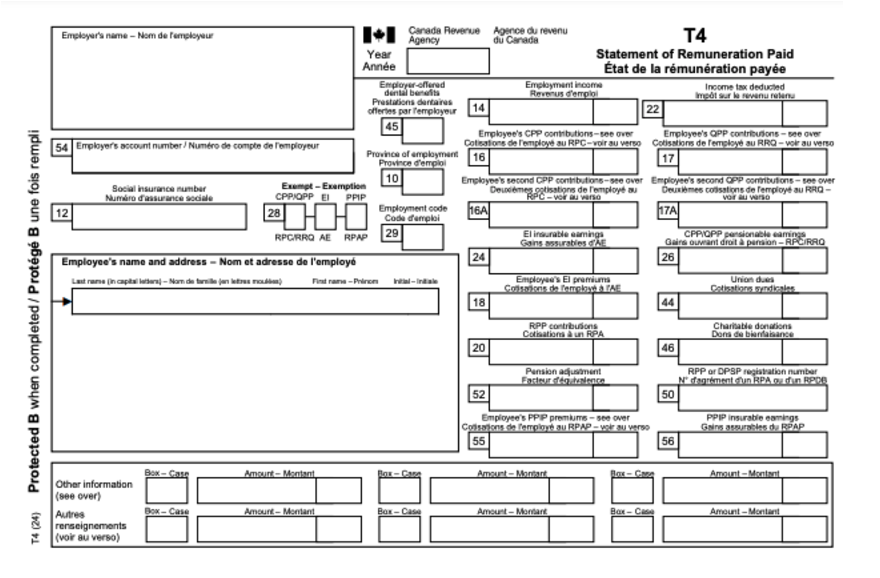

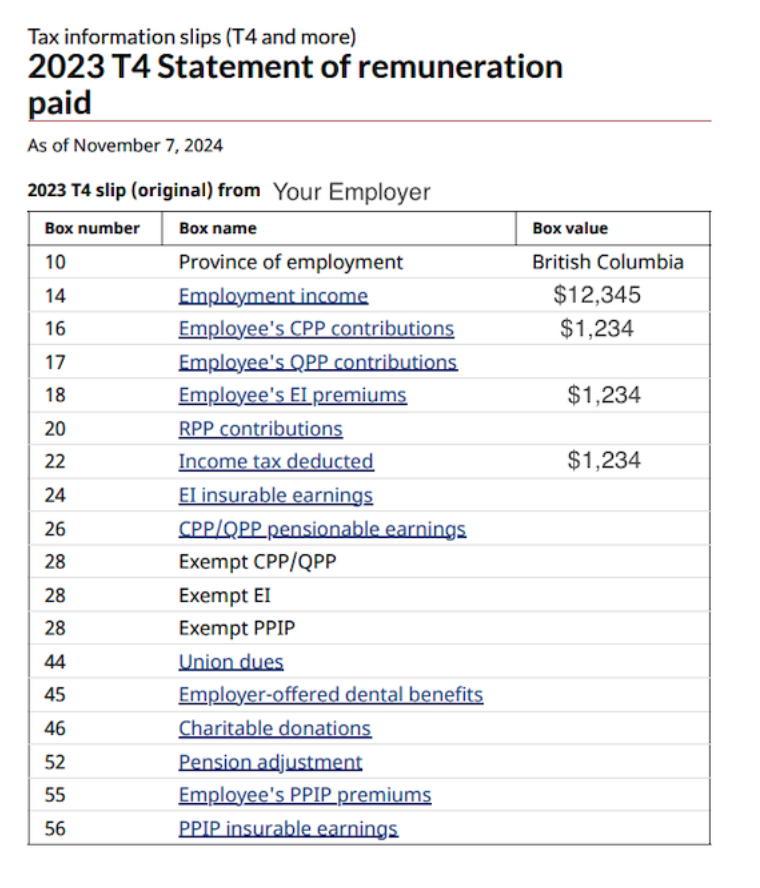

A T4 (Statement of Remuneration Paid) is a tax slip that shows how much employment income you earned and what was deducted throughout the year. It includes:

- Your total employment income

- Income tax deducted

- CPP contributions

- EI premiums

- Pension contributions

- Other deductions

- Your employer's name and address

How to Get Your T4

Option 1: From Your Employer

- Employers must provide T4s by end of February each year

- Usually sent by:

- Mail to your home address

- Email (if you've consented to electronic delivery)

- Your company’s employee portal

- Your payroll service provider's website

The T4 from your employer will look like the below:

Option 2: Ask your accountant

When you filed your taxes you would have sent your T4 to your accountant. You can

reach out and ask them for a copy.

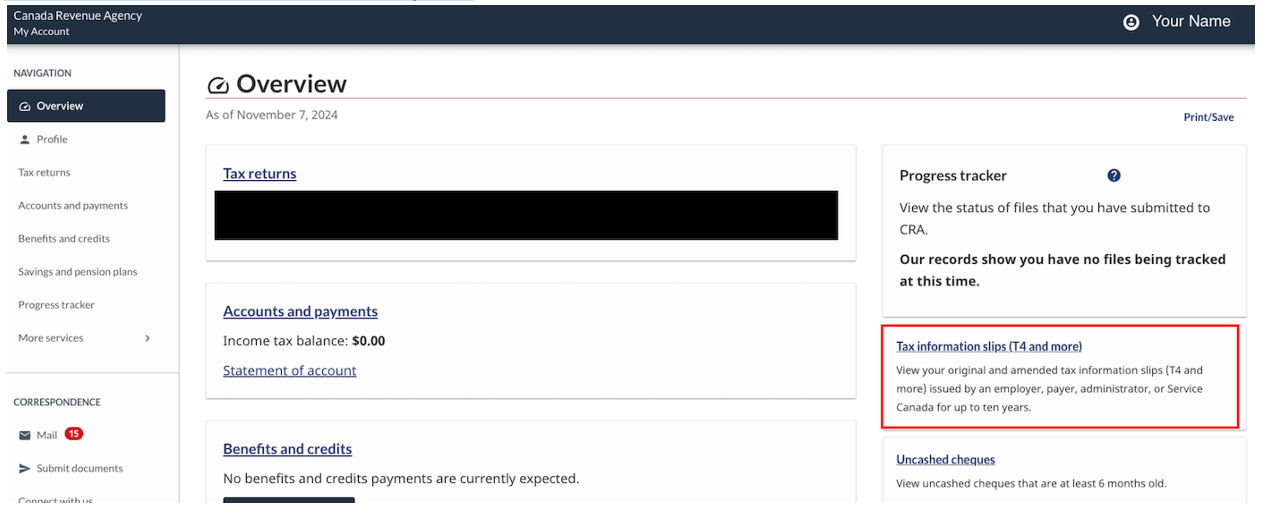

Option 3: CRA My Account (For Current and Previous Years)

(I put this as option 3 because no one likes having to deal with the CRA or their website, but if the first two options aren’t possible, this will work)

1. Visit

www.canada.ca/my-cra-account

2. Log in to your CRA My Account using a sign in partner, username and password or register for an account if you don’t have one yet. You will also likely be required to get a 2FA code texted to your phone.

Note: Using your online banking as a sign in partner will make it much easier to log-in in future.

3. Select "Tax Information Slips"

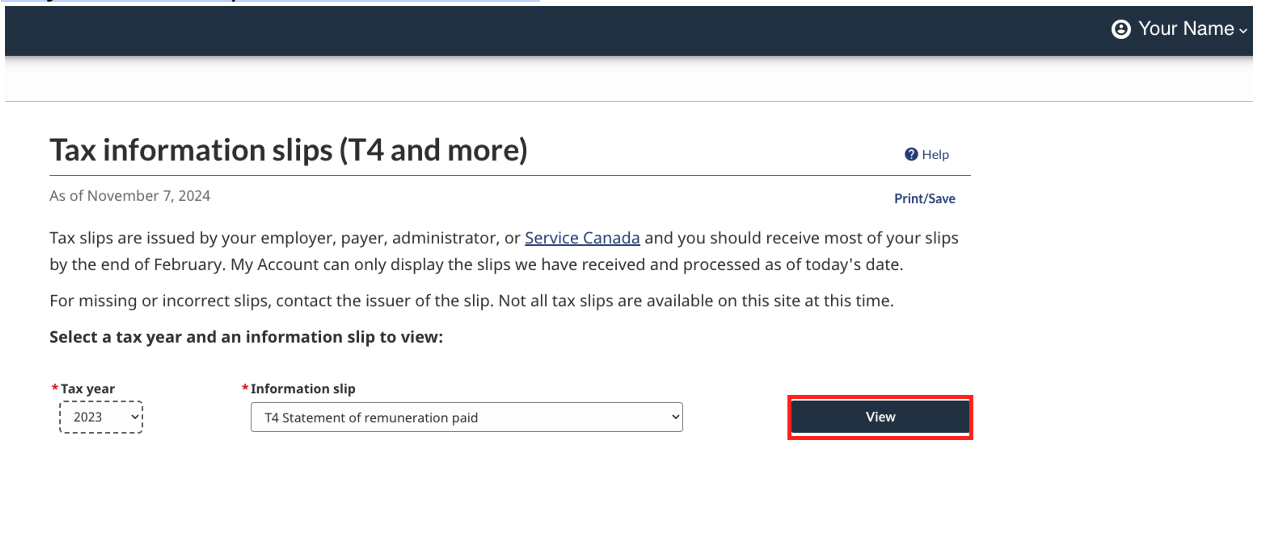

4. Select the tax year and type of slip (likely T4 but if you have other types of income it may be different). Then select “View”

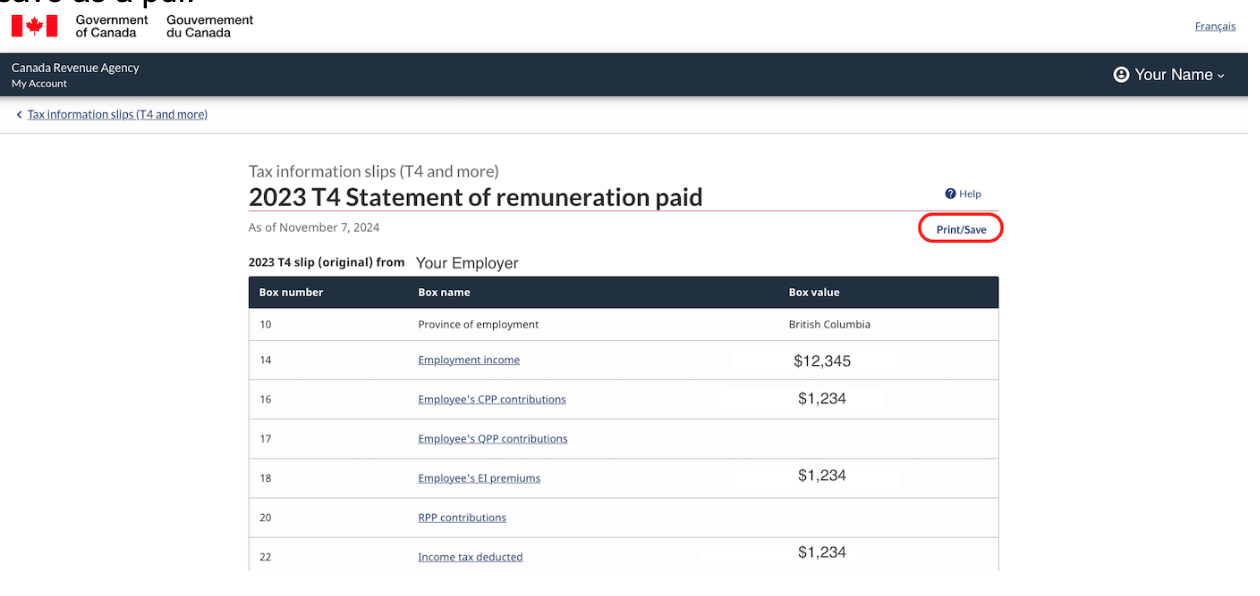

5. When you are on the screen below, take a screenshot and then click print/save and save as a pdf.

The reason for the screenshot is because when you print it, your name wont show up. (No idea why, it’s a CRA bug). So we need to cross reference the screenshot above with the printed version below:

6. Send me the saved pdf and the screenshot.

7. Repeat steps 4-6 for the other tax years requested and/or if you have other types of tax slips I requested.

* Important Notes

- Keep all T4s in a safe place

- For mortgage applications, we may need the last 1-2 years of T4s

- You may have multiple T4s if you:

- Changed employers during the year

- Work multiple jobs

- Receive pension income (T4A)

- T4s for the current tax year are available by end of February

- Previous years' T4s are available through CRA My Account